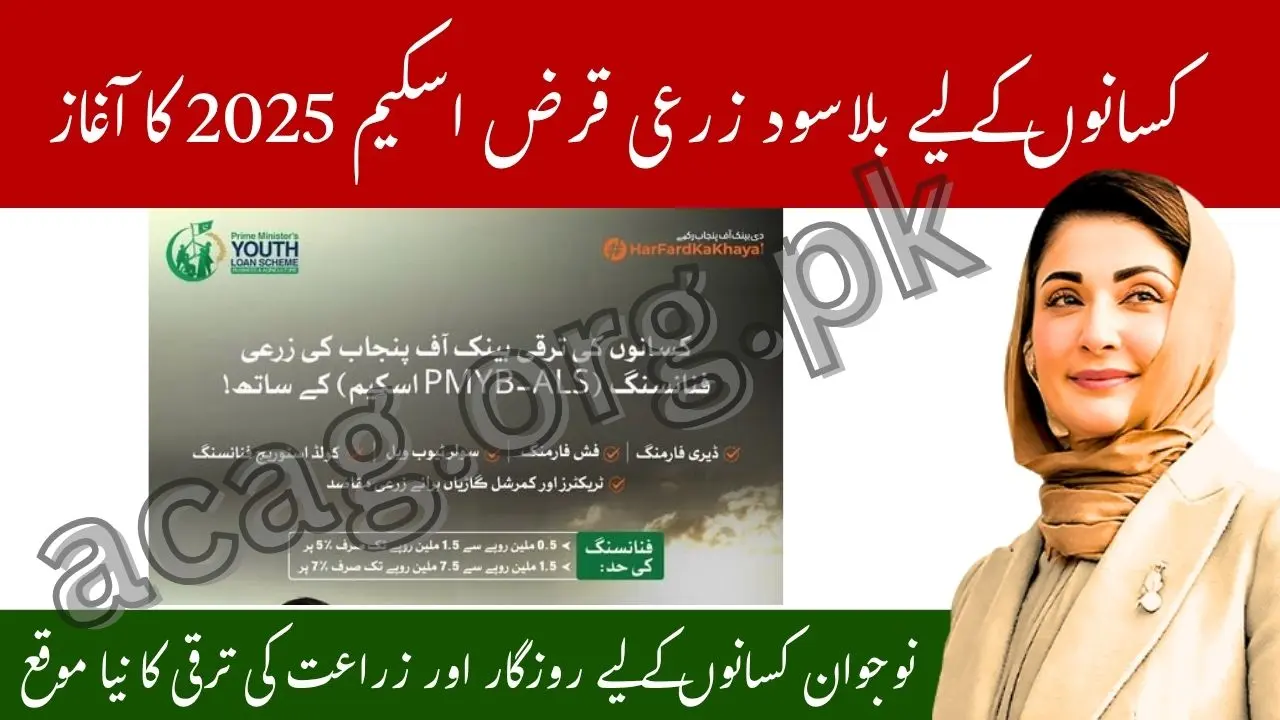

Big Relief for Farmers: Bank of Punjab Starts PMYB-ALS Agricultural Loan Program 2025

Big Relief for Farmers as the Bank of Punjab Starts PMYB-ALS Agricultural Loan Program 2025, a landmark initiative under the Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB-ALS).

This program offers low-markup, easy financing options to farmers for purchasing modern farm machinery, solar tube wells, cold storage facilities, and for expanding dairy and fish farming ventures. The initiative is a key step by the Punjab Government to promote financial inclusion, sustainable agriculture, and rural empowerment across the province.

By easing access to capital, the Bank of Punjab aims to support thousands of small and medium farmers who face challenges in financing agricultural equipment and infrastructure.

Overview – What Is the PMYB-ALS Agricultural Loan Program 2025?

The PMYB-ALS Agricultural Loan Program 2025 is part of the Government of Pakistan’s broader effort to uplift the agricultural sector and empower rural communities.

In partnership with The Bank of Punjab, this program provides affordable loans with simplified eligibility criteria and transparent procedures. Farmers can apply for financing ranging from Rs 0.5 million to Rs 7.5 million, with subsidized markup rates as low as 5% and 7% per annum.

This agricultural loan scheme covers various categories, including mechanized farming, renewable energy systems, livestock production, and food storage—making it one of the most inclusive programs ever introduced for Pakistan’s farmers.

Main Features – Affordable Financing for Farmers’ Growth

The Bank of Punjab has structured the loan program to be farmer-friendly, ensuring flexibility and ease of access.

| Loan Range | Markup Rate | Purpose |

|---|---|---|

| Rs 0.5 – 1.5 million | 5% per annum | Small farmers, equipment purchase, solar irrigation |

| Rs 1.5 – 7.5 million | 7% per annum | Large-scale machinery, cold storage, dairy & fish farming |

Farmers can apply for either short-term or long-term financing based on their agricultural plans. The loan repayment structure is flexible, allowing farmers to pay back over manageable installments aligned with crop cycles.

Check Also: Punjab Launches Free Cow and Buffalo Scheme for Rural Women in October 2025

Eligible Sectors – Expanding Opportunities for Agri-Entrepreneurs

Under the PMYB-ALS Agricultural Loan Program, multiple agricultural sectors have been included to ensure a comprehensive development model.

1. Farm Machinery and Equipment Financing

Loans for tractors, harvesters, seed drills, threshers, and planters—helping farmers move toward mechanized and efficient farming.

2. Solar Tube Well Financing

Funding to install solar irrigation systems to reduce reliance on costly fuel and electricity, promoting energy sustainability.

3. Cold Storage and Supply Chain Infrastructure

Financing for cold storage units and warehouses to help farmers store perishable goods safely, minimizing post-harvest losses.

4. Dairy and Livestock Development

Loans for purchasing livestock, building sheds, and setting up milk processing or distribution units.

5. Fish Farming Loans

Financing for establishing or expanding fish ponds, hatcheries, and feed facilities, enhancing aquaculture production.

Eligibility Criteria – Who Can Apply for BOP’s Agricultural Loan?

The Bank of Punjab has designed simple eligibility conditions to make the program accessible to small farmers, youth, and women entrepreneurs:

- Must be a Pakistani citizen aged 21 to 45 years.

- Have a valid CNIC and proof of farming or agricultural activity.

- Possess agricultural land ownership or lease documents.

- Submit a feasible business or farm plan.

- Preference given to women farmers and young agri-entrepreneurs.

Check Also: Punjab Farmers to Repay Interest-Free Loans in 5 Years Under High-Tech Mechanization Program 2025

How to Apply for Bank of Punjab Starts PMYB-ALS Agricultural Loan Program 2025 – Step-by-Step Application Process

Applying for the BOP PMYB-ALS Agricultural Loan Program 2025 is simple and fully digitalized for convenience.

Step 1: Visit the Official Website

Go to the Bank of Punjab’s official site: www.bop.com.pk. You can also visit the nearest BOP branch.

Step 2: Choose Your Loan Category

Select your desired loan type — Agricultural, Dairy, Fish Farming, Cold Storage, or Solar Energy.

Step 3: Complete Application Form

Provide the following documents:

- CNIC copy

- Land ownership/lease papers

- Passport-size photographs

- Business or project plan

Step 4: Loan Processing and Disbursement

Once the application is reviewed and verified, the Bank of Punjab disburses the approved amount directly into the applicant’s account.

Government’s Vision – Empowering Farmers through Finance

The Punjab Government, under the leadership of Chief Minister Maryam Nawaz Sharif, is focusing on modernizing agriculture and ensuring equitable access to financial resources.

This program aligns with the “Har Fard Ka Khayal” vision — providing every citizen an opportunity to prosper. By empowering farmers financially, the government aims to build a sustainable, technology-driven, and export-oriented agricultural economy.

According to official sources, this initiative will not only strengthen Punjab’s agriculture but also help create thousands of jobs in rural areas through farm mechanization, value-chain expansion, and renewable energy integration.

Benefits – Why the PMYB-ALS Loan Program Matters

The PMYB-ALS Agricultural Loan Program 2025 provides several economic and social benefits:

- Low-cost financing for small and medium farmers

- Improved productivity through modern machinery

- Encouragement of renewable energy via solar tube wells

- Expansion of livestock and aquaculture sectors

- Better food storage and export potential

- Empowerment of rural women and youth entrepreneurs

This is not just a financing scheme — it’s a complete package to transform Pakistan’s agriculture from traditional to tech-driven and sustainable.

Public Response – Farmers Praise BOP’s Initiative

The program has received overwhelming appreciation from Punjab’s farming community. Farmers have termed it a “lifeline” that offers transparency, quick approvals, and affordable credit access.

Experts believe this will mark a turning point for Pakistan’s agri-economy, helping the country move toward self-sufficiency and export growth.

Check Also: Punjab Extends 6-Month Grace Period Under High-Tech Farm Mechanization Financing Program 2025

Frequently Asked Questions (FAQs) about Bank of Punjab Starts PMYB-ALS Agricultural Loan Program 2025

1. What is the maximum amount I can borrow under PMYB-ALS?

Up to Rs 7.5 million, depending on the project’s size and eligibility.

2. What is the markup rate for small farmers?

Small farmers can access loans at just 5% markup per annum.

3. Can women farmers apply?

Yes, the scheme encourages women and youth participation to promote inclusive growth.

4. What is the repayment period

Repayment is structured in easy installments, matching the agricultural cycle.

5. How can I apply?

Apply online via www.bop.com.pk or visit the nearest Bank of Punjab branch.

Conclusion – Big Relief for Farmers and a Bright Future for Agriculture

The Bank of Punjab’s PMYB-ALS Agricultural Loan Program 2025 is a major relief for farmers seeking financial independence and modernization. By offering low-interest, easily accessible loans, the government and BOP are paving the way for a more productive, resilient, and technology-driven agricultural ecosystem.

This initiative is a powerful symbol of Punjab’s commitment to empowering farmers, boosting food security, and ensuring that agriculture becomes the backbone of economic progress in Pakistan.