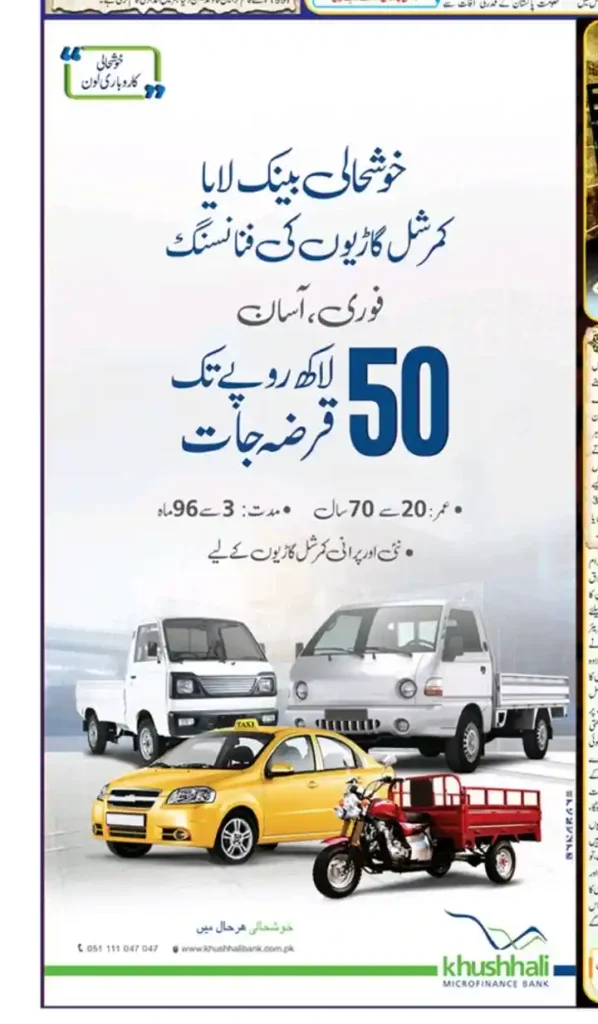

Big Offer Khushhali Bank Starts Rs 5 Million Loan Scheme for New & Used Commercial Vehicles

Khushhali Bank Starts Rs 5 Million Loan Scheme has launched an exciting loan scheme worth up to Rs 5 million for individuals and businesses who want to purchase new or used commercial vehicles in Pakistan. Whether you are a taxi driver, delivery rider, transporter, shopkeeper, or company owner, this scheme gives you the chance to own your vehicle instead of paying rent to someone else. With easy monthly installments, minimum documentation, and fast approval, Khushhali Bank has made vehicle financing extremely accessible for everyone.

This Khushhali Bank Starts Rs 5 Million Loan Scheme is specially designed to support people who want to upgrade their income source. Instead of relying on daily wages or rented vehicles, applicants can now purchase Suzuki Pickup, Toyota Hiace, Changan Karvaan, Mazda Loader, Mini Trucks, Coasters, Rickshaws, Vans, or Delivery Vehicles on financing. The bank allows financing for both new and slightly used vehicles, giving flexibility to choose according to budget.

Read Also: Dalda Foundation Hunarmand Scholarship 2025–2026 – Apply Online for Technical & IT Diploma Stipend

The loan tenure is also highly flexible ranging from 1 year to 7-8 years depending on the customer profile and business type. Khushhali Bank ensures affordable monthly installments, so borrowers don’t feel any financial burden while running their business smoothly. Self-employed individuals, salaried employees, and partnerships can all apply under this scheme. No heavy down payment is required in most cases, and registered businesses can even apply under company name.

Khushhali Bank Starts Rs 5 Million Loan Scheme is becoming impossible for low and middle-income earners to buy a commercial vehicle with full cash. Understanding this problem, Khushhali Bank has stepped in to provide convenient vehicle financing with quick processing and minimum conditions, making it one of the most beneficial commercial vehicle loan schemes in Pakistan.

Check Also: CM Maryam Nawaz eBiz Punjab Portal 2025 – Digital Business Registration in Punjab

✅ Commercial Vehicle Financing Pakistan Eligibility Criteria

To apply for Khushhali Bank’s Commercial Vehicle Loan Scheme, applicants must meet the following requirements:

- Pakistani citizen aged between 21 to 60 years

- Valid CNIC and driving license (for drivers)

- Minimum income proof or business activity evidence

- Bank statement of last 6 to 12 months (if available)

- Clean repayment history / no loan default

- Registered business or employment proof (for SMEs or salaried individuals)

- Vehicle quotation from authorized dealer.

Read Also: Interest-Free Loan Program for Farmers Hi-Tech Machinery Scheme Launched in Punjab

✅ How to Apply Step-by-Step Process:

- Visit the nearest Khushhali Bank branch or contact their customer helpline.

- Request the Commercial Vehicle Financing Application Form.

- Submit CNIC, photos, bank statement, business/employment proof, and vehicle quotation.

- Bank will verify documents and credit score.

- After approval, down payment (if any) is deposited.

- Vehicle is purchased and handed over to the applicant.

- Monthly installments begin as per the chosen repayment plan.

🔑 Key Features of the Scheme

| Feature | Details |

|---|---|

| Loan Amount | Up to Rs 5,000,000 |

| Vehicle Type | New & Used Commercial Vehicles |

| Tenure | 1 to 7 / 8 Years |

| Profit / Markup | Competitive Market-Based Rate |

| Ownership | Vehicle registered under borrower’s name |

| Down Payment | Flexible – Based on profile |

| Insurance & Tracker | Optional / Bank-assisted |

Khushhali Bank Loan Scheme 2025 FAQs:

1. What types of vehicles are allowed under this scheme?

Pickup, Loader, Hiace, Vans, Coasters, Delivery Vehicles, and Rickshaws are allowed.

2. Can I apply without a business?

Yes, salaried employees and drivers with income proof can also apply.

3. Is down payment mandatory?

Minimum down payment varies case-to-case, but in many cases partial financing is offered.

4. Can I get a used vehicle financed?

Yes, slightly used commercial vehicles are also allowed under this scheme.

5. What is the maximum repayment period?

You can choose between 12 months to 8 years.

6. Do I need a guarantor?

In most cases, one guarantor is required for loan security.

7. Is tracker installation compulsory?

Yes, for security purposes, bank may install tracker.

8. Can a company apply for multiple vehicles?

Yes, SMEs and logistics companies can finance multiple units.

9. How long does approval take?

If documents are complete, loan approval takes 7 to 15 working days.

10. Can women apply for this scheme?

Yes, female entrepreneurs and drivers are welcome to apply.

🏁 Khushhali Bank Starts Rs 5 Million Loan Schem Conclusion

Khushhali Bank’s Commercial Vehicle Loan Scheme is a golden opportunity for those who want to start or expand their transport-related business without any financial burden. Instead of paying rent every day to someone else, drivers and entrepreneurs can become proud vehicle owners through this easy installment plan. With flexible tenure, affordable markup, and quick approval, this scheme is highly beneficial for taxi operators, delivery riders, traders, and logistics providers.

If you Khushhali Bank Rs 5 Million Loan are planning to upgrade your income source or expand your delivery network, this is the right time to apply. Visit your nearest Khushhali Bank branch today and take the first step towards financial independence.

Khushhali Bank’s Commercial Vehicle Loan Scheme is more than just financing — it is a pathway to independence and financial growth. For years, thousands of drivers and delivery workers have been operating someone else’s vehicle and earning only a small share of the profit. Now, with this scheme, they finally have the opportunity to become vehicle owners instead of wage earners.

Whether you are a taxi driver, delivery rider, transporter, trader, or small business owner, owning a commercial vehicle can double your income and give you full control over your work. No more rental deductions, no more dependency — this loan program enables applicants to build a stable and sustainable livelihood.

Khushhali Bank has designed this scheme to be simple, flexible, and accessible. With minimal documentation, a reasonable down payment, and long repayment tenure, almost anyone with a genuine income source can qualify. This initiative clearly supports self-employment, entrepreneurship, and business expansion across Pakistan.

Logistics companies, courier services, and wholesale suppliers can also benefit greatly by expanding their fleet through this financing option. With e-commerce and delivery services rapidly growing, there has never been a better time to invest in transportation assets.

Opportunities like this do not come every day. Those who take timely decisions grow faster, while those who wait often miss out. If you have the willingness to improve your life, this loan could be your breakthrough moment.

Visit your nearest Khushhali Bank branch today, apply for the Commercial Vehicle Loan, and start your journey toward financial freedom. A small step today can change your future forever.

Big Offer Khushhali Bank Starts Rs 5 Million Loan Scheme