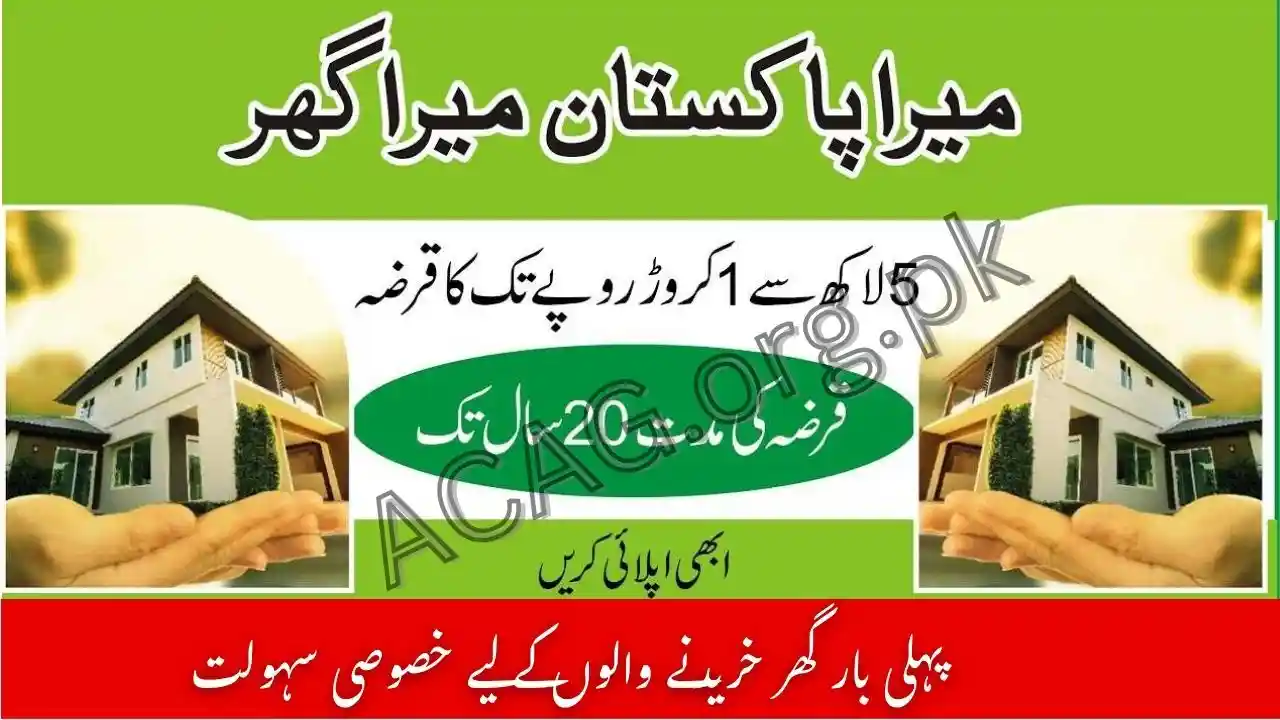

Top Benefits of Mera Pakistan Mera Ghar Scheme for Low-Income Families

The Top Benefits of Mera Pakistan Mera Ghar Scheme for Low is a government initiative aimed at providing affordable housing solutions to low-income families across Pakistan. This scheme plays a pivotal role in addressing the country’s housing crisis by making homeownership more accessible, particularly for those who have previously been unable to afford a home. In this article, we will explore the top benefits of the Mera Pakistan Mera Ghar Scheme for low-income families, and how it is transforming the housing landscape in Pakistan.

1. Affordable Homeownership for Low-Income Families?

One of the most significant benefits of the Mera Pakistan Mera Ghar Scheme is its focus on providing affordable homes to low-income families. In a country where millions struggle with rising rental prices and escalating property costs, this scheme offers an opportunity for families to own homes without burdening them with excessive financial strain.

The government offers subsidized interest rates on housing loans, making it easier for low-income families to access home financing options. By reducing the financial barriers to homeownership, the scheme empowers families to become homeowners, improving their standard of living and providing them with a permanent place to call home.

Read More: Top Benefits of Mera Pakistan Mera Ghar Scheme for Low-Income Families

2. Subsidized Financing with Low-Interest Rates?

One of the standout features of the Mera Pakistan Mera Ghar Scheme is its provision of subsidized financing. The scheme offers low-interest rates for housing loans, which is crucial for low-income families who may otherwise be unable to secure affordable financing options from commercial banks.

Typically, commercial bank loans come with high-interest rates, making it difficult for low-income families to afford homeownership. However, under this scheme, the government steps in to provide financial assistance that significantly reduces the financial burden of monthly repayments. This subsidized interest ensures that families can repay their loans without stretching their financial resources too thin.

3. Easy Access to Home Financing?

The Mera Pakistan Mera Ghar Scheme simplifies the home financing process, ensuring that low-income families do not face excessive paperwork or bureaucratic obstacles. The government has streamlined the application process, making it easy for eligible families to apply for loans.

The scheme is designed to ensure accessibility for everyone, particularly the marginalized and economically disadvantaged. With online applications and a simplified approval process, families can quickly assess their eligibility and apply for loans without facing long delays. This level of accessibility makes the process more efficient, reducing the stress that families typically face when navigating complex loan procedures.

Read More: How to Apply for Mera Pakistan Mera Ghar Scheme 2025

4. Support for First-Time Homebuyers?

The scheme places a special emphasis on supporting first-time homebuyers who are unfamiliar with the process of purchasing a home. For many low-income families, buying a house is a daunting task. The Mera Pakistan Mera Ghar Scheme addresses this by offering support and guidance throughout the process.

First-time homebuyers benefit from lower down payments, flexible repayment plans, and lower rates compared to traditional home loans. The government’s backing of this initiative makes homeownership a realistic goal for those who have never owned a house before, helping them make informed decisions about the property they choose.

5. Increased Security and Stability?

Homeownership is not just about having a physical space to live in; it is about creating stability and security for the family. By owning a home, low-income families no longer have to worry about fluctuating rental prices or the uncertainty of landlords.

Having a permanent residence creates a sense of security and stability for families, providing a foundation for their future. Homeownership often leads to improved mental and emotional well-being, as families no longer have to endure the anxiety and instability of renting. The Mera Pakistan Mera Ghar Scheme provides this essential security, ensuring that low-income families can thrive in their own homes.

6. Boost to Local Economies?

The implementation of the Mera Pakistan Mera Ghar Scheme has far-reaching effects beyond just the families that benefit directly. The construction of homes and the subsequent economic activities that follow significantly contribute to the local economy.

As more homes are built, there is an increase in demand for building materials, labor, and services. This creates jobs in the construction industry and stimulates growth in local businesses. Furthermore, the homeowners themselves contribute to the economy by spending on goods, services, and infrastructure improvements in their communities.

7. Improvement in Living Standards?

The Mera Pakistan Mera Ghar Scheme has a direct impact on the living standards of low-income families. Owning a home not only provides families with stability, but it also leads to better living conditions. With access to modern amenities and the ability to personalize their homes, families can enjoy a more comfortable lifestyle.

For many low-income families, renting substandard properties often means dealing with overcrowding, poor sanitation, and a lack of basic utilities. The scheme provides families with homes that are built to modern standards, offering them a safe, comfortable, and well-equipped living space that improves their overall quality of life.

8. Support for Rural and Urban Development?

The scheme is not limited to urban areas but extends its benefits to rural regions as well. This ensures that low-income families living in rural areas also have the opportunity to benefit from government-backed homeownership.

By supporting both rural and urban families, the Mera Pakistan Mera Ghar Scheme plays a role in the balanced development of the country. Rural areas, often neglected in housing projects, benefit from this initiative by providing families with affordable housing options, reducing migration to urban centers, and fostering local development.

9. Promotion of Social Welfare and Poverty Reduction?

A major long-term benefit of the Mera Pakistan Mera Ghar Scheme is its contribution to poverty reduction. Homeownership is a significant driver of social welfare. By helping low-income families secure a permanent place to live, the government is taking a step toward improving their socio-economic status.

Owning a home leads to greater financial independence. Families are able to build equity in their property, and over time, this improves their financial standing. Moreover, the reduction in rental costs allows families to allocate funds to other essential needs such as education, healthcare, and savings, which further promotes social welfare.

10. Long-Term Financial Investment?

Owning a home is one of the best ways to build long-term wealth. Unlike renting, where payments are lost, homeownership allows families to accumulate equity over time. The Mera Pakistan Mera Ghar Scheme ensures that low-income families can invest in their futures by purchasing property that appreciates in value.

Over the years, the value of homes in many areas of Pakistan has risen significantly, providing homeowners with an opportunity for financial growth. Families can also sell or mortgage their homes if necessary, providing them with financial leverage when needed. This scheme provides families not just with shelter but also with the potential for long-term financial security.

Read More: Eligibility Criteria for Mera Pakistan Mera Ghar Scheme 2025

FAQs Mera Pakistan Mera Ghar Scheme for Low?

1. Who is eligible?

Low-income families and first-time homebuyers who meet the government’s criteria.

2. What are the interest rates?

The scheme offers subsidized, lower-than-market interest rates on housing loans.

3. How to apply?

Apply online via the official portal or visit a participating bank.

4. What is the maximum loan amount?

The loan amount depends on property type and location but covers affordable homes.

5. Is there any financial assistance?

Yes, the scheme provides subsidized interest rates and government-backed loans.

Conclusion Top Benefits of Mera Pakistan Mera Ghar Scheme for Low?

The Mera Pakistan Mera Ghar Scheme is a transformative initiative that brings numerous benefits to low-income families across Pakistan. By providing affordable homeownership opportunities, subsidized financing, and increased security, this scheme offers a path to a brighter and more stable future for thousands of families. As it continues to gain momentum, the Mera Pakistan Mera Ghar Scheme will undoubtedly play a key role in addressing Pakistan’s housing challenges and contributing to the socio-economic well-being of its citizens.

For low-income families, this scheme is more than just a housing initiative; it is a chance to secure a better life, create stability, and build a foundation for future generations. With the government’s continued support, the Mera Pakistan Mera Ghar Scheme will remain a beacon of hope and opportunity for many in Pakistan.